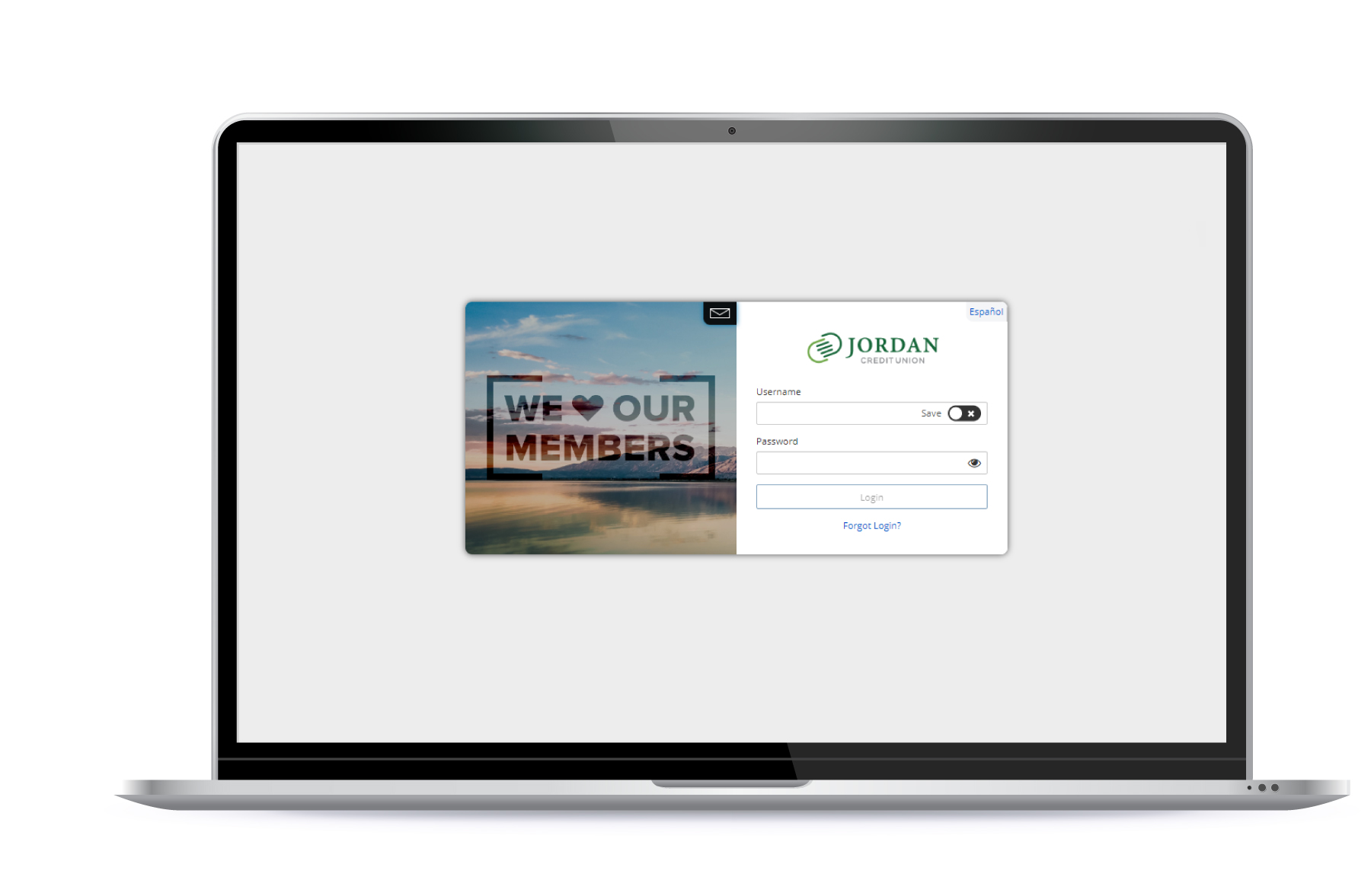

Online Banking

Balances, transfers, loan payments, loan applications, address changes, and more 100% online.

Online Banking truly is an electronic teller for most of your banking needs. After securely logging into Online Banking, you can:

- Look at a detailed account history on all of your linked accounts

- Transfer money between account suffixes, or between accounts

- Make loan payments

- Set up one-time or automatic bill payments

- Find and print monthly statements and/or tax information

- Change your address

If you are already registered with Online Banking access with the button below.

Don’t have a login? Register here

Online Banking